Sell Your ATM Route with Confidence

From your first call to the final signature,

we ensure a smooth, fair, and seamless route sale experience.

Check Out Our ATM ACQUISITION process below!

FINANCIAL BENEFITS FOR ATM ROUTE OWNERS

Quick & Fair Offers

Get an initial offer within 3-5 business days based on your portfolio's details.

Hassle-Free Process

From initial discussion to closing, we manage the steps so you don’t have to.

Transparent Transactions

Clear communication and fair market valuations at every stage.

Meet our founders

CJ McMahon

CEO & Founder

ATM Investment Pioneer | Capital Raising Specialist

8-Figure Revenue & Marketing Architect

Private Equity & Acquisition Expert

Strategic Business Development Leader

Innovator in Financial Technology

Mike Anderson

COO & Co-Founder

8+ Years of Operational ATM Experience

Systems, Process and People Specialist

ATM Mergers & Acquisitions Expert

Operational Efficiency Catalyst

Financial Technology Strategist

WHAT WE DO

We build & operate ATM businesses for investors

1

INITIAL CALL

Discuss Your Portfolio: Share details about your ATM route, including the number of ATMs, locations, and performance metrics.

Understand Your Goals: Let us know your priorities, such as desired timeline, valuation expectations, or other key considerations.

No-Pressure Conversation: Get answers to your questions and learn about our process in a friendly, informative call.

1

Location Acquisition

We source cash-only businesses and high foot traffic businesses like barber shops, gas stations, nail salons, and much more

Our data analytics team measures business revenue, foot traffic, demographics, and time in business to ensure high performance of your ATM location.

Proven acquisition system that currently onboards 200+ new high performing ATM locations per month!

2

Offer Submission

Fast Turnaround: Receive a competitive initial offer within 3-5 business days based on the details shared during our call.

Transparent Valuation: Our offer reflects a fair market assessment of your route's performance and growth potential.

No Commitment: Review the offer at your own pace with no obligation to proceed until you're ready.

3

Document Review & Portfolio Evaluation

Streamlined Document Collection: Submit key documents like transaction reports and financial summaries through our simple and secure process.

Thorough Analysis: We evaluate your route’s performance, financials, and growth opportunities to provide an accurate valuation.

Clear Communication: Stay informed throughout the process with updates on the evaluation progress.

Fair Market Valuation: Our experts use industry benchmarks and your portfolio’s unique strengths to determine its value.

3

ATM Maintenance

Cash levels in each ATM are maintained so there is zero down time for your unit.

Our experienced technicians are ready to tackle any technical issues that may arise.

4

Due Diligence & Closing

Final Agreement Preparation: We handle all necessary agreements and ensure everything is aligned for a smooth transition.

Comprehensive Due Diligence: Our team reviews all documents and ensures compliance with industry standards.

Efficient Process: Close the deal quickly, with most transactions finalized within weeks.

Secure Payment: Receive your payment promptly and securely once the transaction is complete.

Let our team of experts and professionals build and manage your portfolio for you!

Our team has you covered start to finish

From our location acquisition team comprised of data analysts, relationship managers, and advertising team; to our expert portfolio managers; all the way to our boots on the ground technicians and cash loading team, we have all bases covered to effectively manage and grow your ATM enterprise to provide a completely passive investment vehicle for you to rely on!

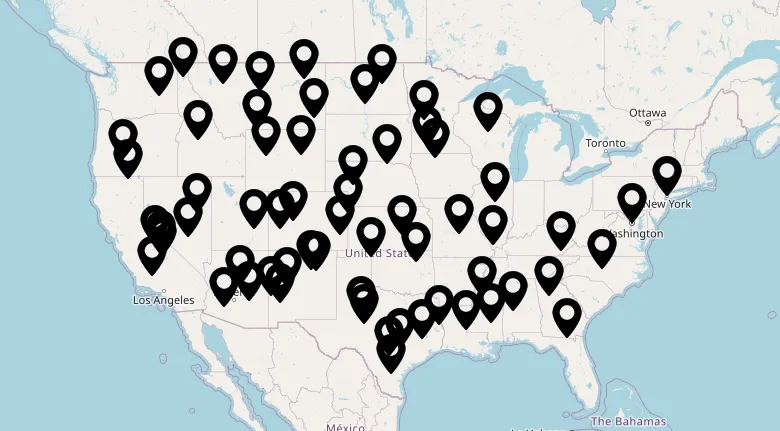

ATMS ACQUIRED ACROSS THE UNITED STATES LAST MONTH

WHO WE PARTNER WITH

FAQ

Why should I sell my ATM route/business to you?

We offer a streamlined, investor-backed acquisition process with competitive purchase prices, expert due diligence, and a seamless transition that minimizes disruption to your merchants.

How do you determine the value of my ATM route or business?

Our financial analysts evaluate key factors such as the route's EBITDA, transaction volume, location quality, and contractual agreements to determine a fair market value.

What is the typical timeline for selling my ATM route?

Our acquisition process usually takes between 30-60 days from initial discussion to closing.

Will my merchants experience any disruption during the transition?

No. We prioritize merchant satisfaction and ensure a smooth transition with minimal impact on their operations.

What documents or information do I need to provide for the sale?

You’ll need to share financial statements, ATM transaction reports, contracts with merchants, and details about the machines, such as ownership and age.

What types of ATM businesses/routes do you purchase?

We acquire individual routes, portfolios, or entire ATM businesses, including those with managed service agreements or fully owned machines.

Do you buy ATM routes in all locations, or are there geographic restrictions?

We operate nationwide and are interested in routes across the United States, provided they meet our criteria for profitability and growth potential.

How are payouts structured? Will I receive all the funds at closing?

Yes, in most cases, we offer a lump-sum payout at closing. However, for larger acquisitions, we can structure payments to fit mutual agreements.

What if my ATM route includes aging or outdated machines?

We assess the entire portfolio and consider machine age, compliance status, and upgrade costs in the valuation process. If upgrades are needed, we can handle them post-acquisition.

sell

your atm

route

INTERESTED IN SELLING?

Click below to get an offer.

featured in

ATM Investors is proud to offer the first done for you ATM partnership of its kind with the backing of 20 years of industry expertise and 3000 units under management. Schedule a call with us to see how we can help you build your passive ATM enterprise.

QUICK Links

Contacts

ATM Acquisitions is proud to offer the first done for you ATM partnership of its kind with the backing of 20 years of industry expertise and 3000 units under management. Schedule a call with us to see how we can help you the best offer for your ATM Route.

© 2026 ATM Acquisitions. All rights reserved.